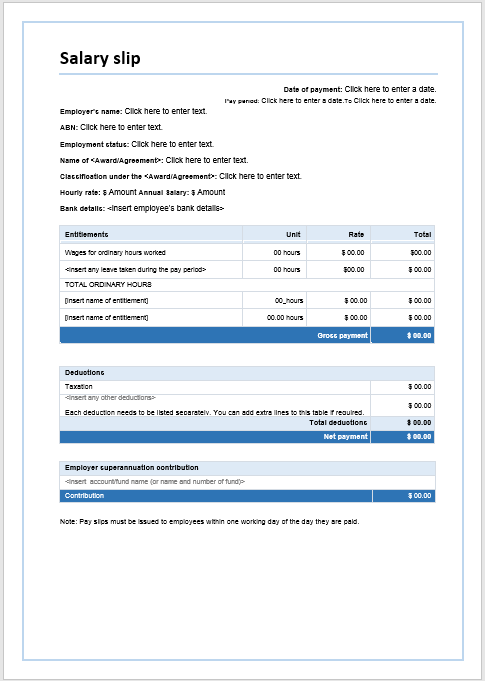

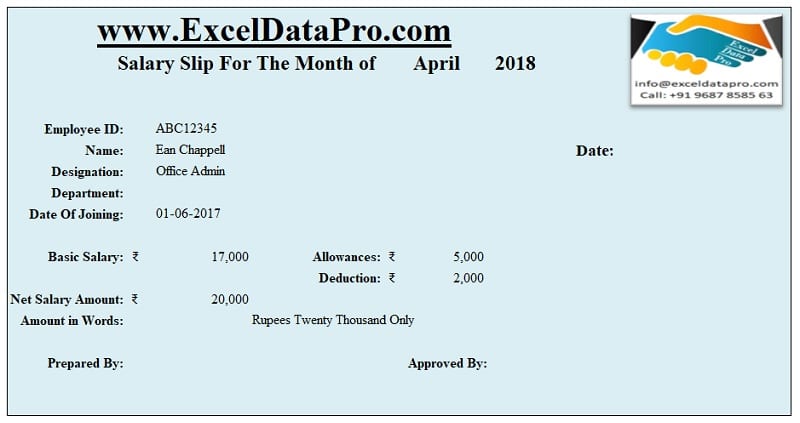

Should be compliant with norms like minimum wages, PF laws.If you’re looking to create an accurate salary structure, three things should be kept in mind which are: How to Calculate Salary Structure for Employees in India? Private companies can restructure pay slips for the best tax planning and welfare of employees, subject to the regulations of Wage Code and Income Tax Act. The allowances are subject to the maximum allowed allowance as per Income Tax India, 1961. Note: The Salary structure on the table is a preferred structure for private companies per the New Wage Code for F.Y 2022-23. But calculated for the unclaimed figure taxable But calculated for the unclaimed figure which is taxable. Vehicle Reimbursement (Applicable to those who own car) But calculated for the unclaimed figure taxable. Given below is a detailed breakdown of the standard salary structure format: Fixed Salary Component However, if the salary structure becomes clear, employees would not only be able to clear the confusion on their own, but also be able to save unnecessary hassles of exchanging emails with the payroll department. This leads to miscommunication and often leaves employees irate and disgruntled about the deductions. Salary Structure in India: All You Need to Know 2022-23Īs a layman, often employees struggle to understand the salary structure format implemented by their organisation. How Does Salary Breakup Calculator Work?.Employer Provident Fund/EPF or Provident Fund.

0 kommentar(er)

0 kommentar(er)